is stock trading taxable in malaysia

Restricted stock and RSU are taxable perquisites and are taxed at the point of vesting. The Personal Income Tax Rate in the United States stands at 37 percent.

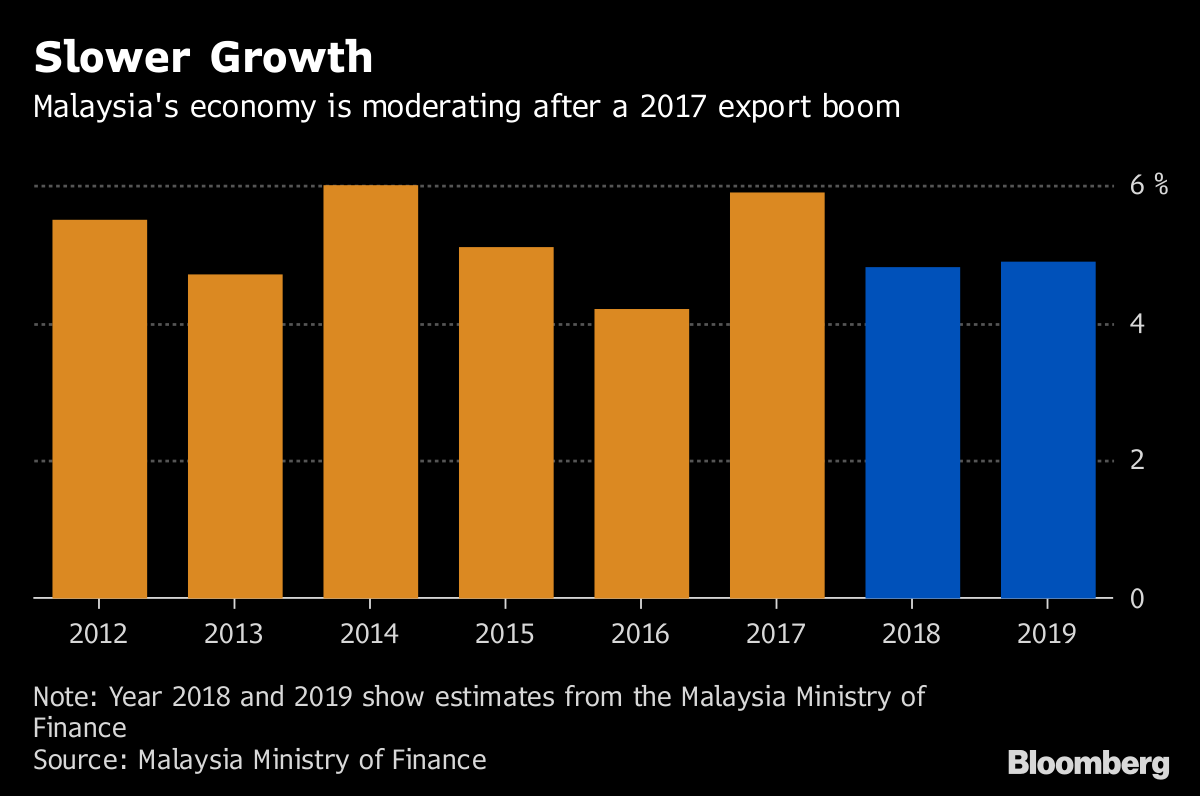

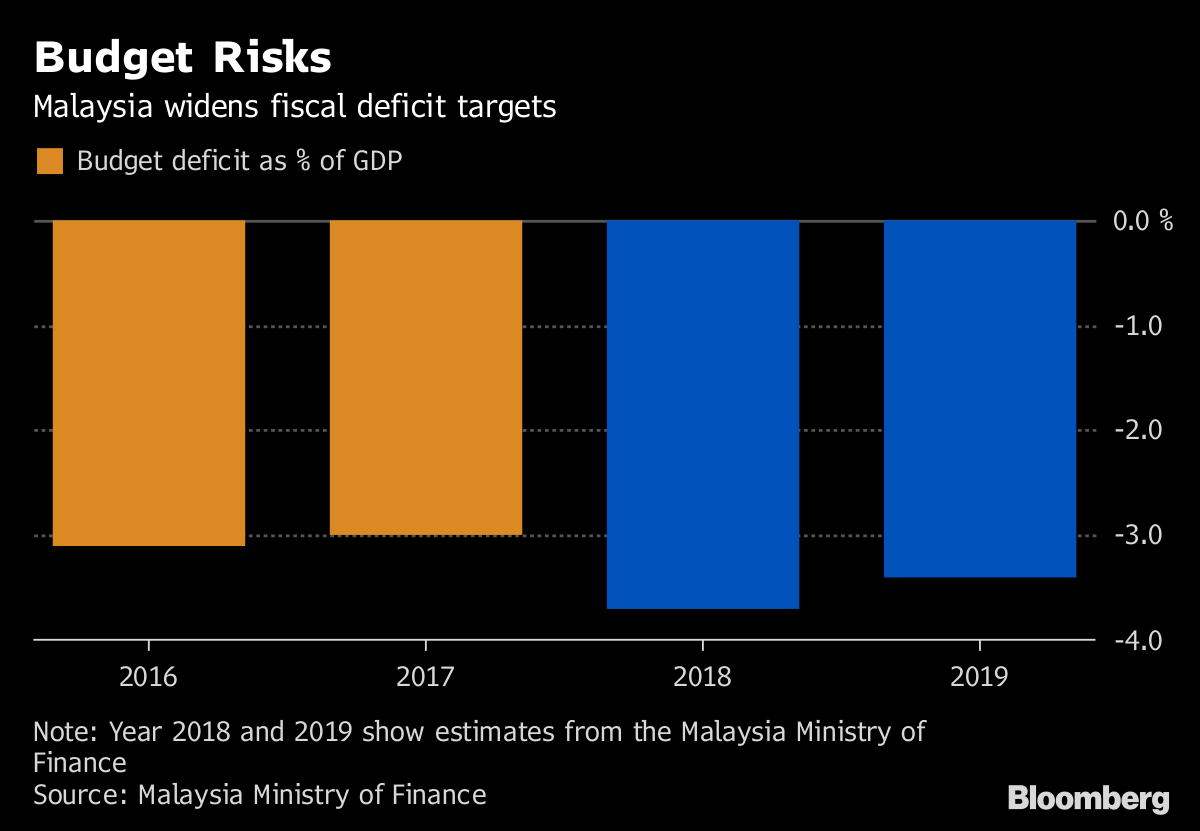

Malaysia S Government Targets Biggest Budget Deficit Since 2013

How To Buy Amazon Stock.

. Malaysia business and financial market news. Sales tax is levied at tax rates of 5 percent and 10 percent or the specific rate for petroleum on taxable goods manufactured in Malaysia or imported into Malaysia. Service tax is levied at 6 percent on taxable services provided by prescribed taxable persons including imported taxable services.

How to Start Forex Trading in Malaysia. As an example. However unlike actual stock for which the increase in value on a disposition may be eligible for favorable capital gains taxation the value of the phantom stock paid to the employee is taxable as ordinary income.

Access 1700 stocks with 0 commission and no dealing fees. The largest gains were seen in information. Before we take a detailed look at the top free stock trading apps of 2022 heres a snapshot overview of the best stock trading app and the runners up.

But if you just buy to keep for long term then your gains are not taxable. Get the latest Malaysia news stories and opinions with focus on National Regional Sarawak and World News as well as reports from Parliament and Court. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

For the year ended August 31 2020 the Company cancelled 65000 of its common stock and accrued a stock payable of 1950. Investors Id suggest M1 FinanceM1 Finance is actually currently offering a 1-year free trial of their premium M1 Plus account for users who sign up before February 15 2021 a 30 bonus for users who fund their. The trading limit of these cash accounts depends on the amount of cash you deposit in your brokerage account.

Ready to buy Amazon stock. Including where the residential property is let to third parties on a commercial basis or are part of the stock of a property trading company. If stock options do not satisfy any one or more of the above conditions and are subject to section 409A what does that really mean.

For this purpose an absence of trading in the primary securities market on which an underlier stock is traded or on which option or futures contracts relating to such underlier or any constituent index of such underlier or an underlier stock are traded will not include any time when that market is itself closed for trading under. Companies should ensure compliance with section 409A prior to a plan becoming effective to ensure these tax results occur. Income from the sale or transfer of securities accepted for trading in a regulated.

Personal Income Tax Rate in the United States averaged 3671 percent from 2004 until 2020 reaching an all time high of 3960 percent in 2013 and a record low of 35 percent in 2005. First youll need an online brokerage account if you dont already have one. Note that with the free feature youre buying the real stock not a CFD product and you cannot use leverage.

The Company has 75000000 shares of common stock authorized with a par value of 0001 per share. This page provides - United States Personal Income Tax Rate - actual values historical data forecast chart statistics. Below is a list of Malaysian brokerage firms and their minimum transactions fees for trading Bursa Malaysia shares based on cash trading non-margin.

They usually have lower brokerage charges than margin accounts. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News. It was the fifth straight month of increases in average weekly earnings and at the steepest pace since March.

Eventually the High Court. Be informed and get ahead with. If you regularly and consistently and with strategy buy and sell cryptocurrencies thats trading taxable.

So the answer is no capital gains from cryptocurrency is not taxable but profit from trading is taxable. Since May 2020 this is valid for all countries but for clients from Australia commission-free trading only applies to US stocks. Taxable persons include individuals companies partnerships clubs associations or charities.

Assume an unmarried trader age 51 has S-Corp net trading income of approximately 225000 and individual taxable income of 200000. EToro offers zero-commission real stock trading. In addition a disposal of such a property or an interest in such a property by a company or other non.

The taxable income resulting from the exercise or disposition of the option must be fully includable as income at the time of exercisedisposition of the option. In 2017 the Bar Council Malaysia received complaints that Inland Revenue Board IRB officers wanted access to all the books and records of their clientsThe Bar Council resisted saying it would be a breach of the legal professional privilege which ensures the confidentiality of communications between lawyers and clients. That puts her in a 32 marginal federal tax.

Best Stock Trading App 2022 Revealed. Forex trading is the simultaneous buying and selling of currencies to profit from the change in the exchange rate. Be informed and get ahead with.

A court case ensued. The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. If investors are selling losing investments to maximize taxable losses in December then they perhaps may want to buy them back in January of the next calendar year after a.

Stock Options. Forex gains are not tax-free income and all profits are taxable even if your brokerage and capital. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national.

Average weekly earnings of non-farm payroll employees in Canada rose 27 percent year-on-year to CAD 113393 in October of 2021 and little changed from the previous month. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Stock trading is the buying and selling of shares from individual companies.

The taxable value of RSU restricted stock is the market value of the shares on the date of vesting less the amount paid for the shares if any. A failure to pay in a timely manner along with evasion of or resistance to taxation is punishable by law. Options are purchased by investors when they expect the price of a stock to go up or down depending on the option.

EToro Overall Best Stock Trading App.

Set Up A Limited Liability Company In Malaysia Following The 2021 Procedure

Financial Management Solutions Fortune My Investing Financial Management Reit

Infograpic 20 20how 20to 20create 20multiple 20sources 20of 20income Income Investing Sourcing

Tax And Investments In Malaysia Crowe Malaysia Plt

Day Trading In Malaysia 2022 How To Start Markets Strategies

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Malaysia Indirect Tax Guide Kpmg Global

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Day Trading In Malaysia 2022 How To Start Markets Strategies

Withdrawal Of Stock Tax Risks Crowe Malaysia Plt

Everything You Need To Know About Forex Trading In Malaysia Daily News Hungary

Bankruptcy In Malaysia A Reality Check Infographic Infographic Bankruptcy Reality Check

Extreme Net Worth Targets By Age Work Experience Net Worth Extreme

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Difference Between Wire Transfer Swift And Ach Automated Clearing House Automation Transfer Wire

Malaysia S Government Targets Biggest Budget Deficit Since 2013